maricopa county tax lien foreclosure process

Download as PDF. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale.

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Every February in Arizona all 15 counties hold tax lien.

. At the end of the sale it is your responsibility to Checkout and pay for the tax liens awarded to you within twenty four hours of the close of the Online Tax Lien Sale. August 2017 TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library. Step 3 Next the Arizona County Recorder requires you assign a Mail.

Tax Lien Web Assignments Purchase Form Instructions Assignments Purchase Form Current State CP Listing Current State CP Listing Downloads. Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose. Maricopa County Az Quit Claim Deed Form.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Every year the counties have auctions to sell these unpaid property tax liens. By Mike Fimea Arizona Business Gazette February 19 2004 volume 124.

Buying Selling Real Estate Discussion Found a property with a tax lien against it. For example Maricopa County conducts its on-line auction in February of each year. Preview and bidding will begin on January 26 2021.

All bidders are required to deposit 500 or 10 of anticipate d bid whichever is greater. The attorneys here have been involved with a form of Arizona real estate investment known as Certificates of Purchase CP or real property tax liens for the past twenty-four years. Download as CSV.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Maricopa County AZ at tax lien auctions or online distressed asset sales. If the tax lien is not redeemed within the specified timeframe then youll have the opportunity to pursue a foreclosure on the property. Download a list of tax liens available for purchase please be patient this.

Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. That would mean that as of 2013 you can foreclosure any tax lien certificate purchased in 2010.

Prior to initiating the court action the CP holder is required to give the property owner a minimum of thirty days notice by certified mail of the impending foreclosure. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Those liens with deadlines that are already in effect will not be affected however it will affect all future sub taxing liens so that the deadline will expire within a ten year period after the last day of the month that it was acquired and time.

Now what May 7 2021 1125. Maricopa County Recorders office is where to file an Arizona quitclaim deed if the. Maricopa County CA tax liens available in CA.

All groups and messages. To understand how the form must be created to satisfy the. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

What is the tax deed process. These listings may be used as. When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount.

However if you buy subsequent tax liens on the same property you. Interested in a tax lien in Maricopa County AZ. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

Maricopa County County AZ tax liens available in AZ. For example Maricopa County conducts its on-line auction in February of each. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale.

There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or worth pursuing. How does a tax lien sale work. Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value.

The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. Visit Arizona tax sale to register and participate. You have to wait three years after you buy the tax lien certificates to foreclose.

The Tax Lien Sale will be held on February 9 2021. Maricopa County Arizona Reload. After three years from the date of the tax lien sale but no later than 10 years the CP holder may begin a judicial foreclosure action to obtain ownership of the property.

General Foreclosure. Shop around and act fast on a new real estate investment in your area. Delinquent and Unsold Parcels.

The interest on a certificate ranges from 0 to 16. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. Maricopa County AZ Tax Liens and Foreclosure Homes.

These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest. The MARICOPA COUNTY DELINQUENT TAX LIEN SALE WAS GOOD NEWS FOR. HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647.

Every year the counties have auctions to sell these unpaid property tax liens. He had been buying liens in maricopa county for years with nearly 200 in 2010 alone but soon left the entire industry for good. Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process.

The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County. Shop around and act fast on a new real estate investment in your area. The Arizona quitclaim deed is a form used to transfer property from one person to.

Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders. As of October 2 Maricopa County AZ shows 1469 tax liens. Maricopa County AZ currently has 17462 tax liens available as of April 16.

An Interview With The Maricopa County Treasurer Asreb

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Property Taxes In Arizona Lexology

23 Affidavit Of Ownership Of Real Property Page 2 Free To Edit Download Print Cocodoc

An Interview With The Maricopa County Treasurer Asreb

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business

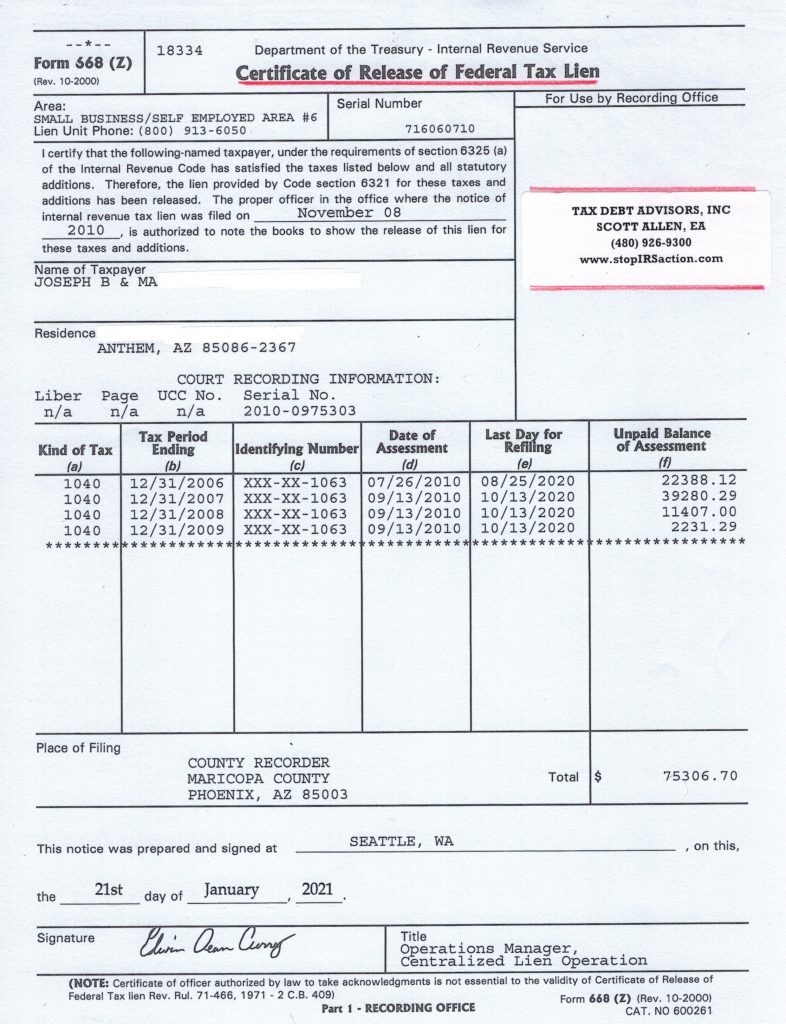

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Az Quit Claim Deed Form Best Reviews

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Maricopa County Treasurer S Office John M Allen Treasurer

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers